Real Estate Investment Trusts, commonly known as REITs, are becoming one of the most talked-about investment vehicles in Pakistan. With growing urbanization, rising property demand, and improved regulations, REITs are slowly transforming how people participate in real estate investments.

Instead of buying property directly, investors can now invest in professionally managed real estate portfolios through REITs. This opens the door for individuals and institutions to earn income from real estate without dealing with construction, maintenance, or tenant management.

What is a REIT?

A REIT is a company or trust that owns, operates, or finances income-generating real estate.

REITs typically invest in:

- Commercial buildings

- Shopping malls

- Office spaces

- Residential projects

- Warehouses and logistics parks

They generate income mainly from rent or property value appreciation and distribute profits to investors.

You can also read: Apna Khet Apna Rozgar Scheme Apply Online

Why REITs Matter for Pakistan’s Economy

REITs introduce structure and professionalism into a traditionally informal sector.

They help:

- Attract institutional investment

- Improve market transparency

- Encourage documentation

- Create new investment channels

SECP’s Role in Strengthening the REIT Sector

The Securities and Exchange Commission of Pakistan (SECP) plays a central role in regulating and developing Pakistan’s capital markets, including REITs.

Through policy reforms and improved regulations, SECP is actively working to make REITs more attractive, safer, and easier to operate.

Overview of SECP

SECP regulates:

- Stock markets

- Mutual funds

- Insurance companies

- Corporate entities

- REIT schemes

Its goal is to protect investors while promoting sustainable market growth.

Regulatory Improvements Under REIT Regulations 2022

The revamped REIT Regulations 2022 introduced:

- Simplified registration procedures

- Clearer operational guidelines

- Mandatory listing timelines

- Stronger governance standards

These reforms aim to increase investor confidence and market participation.

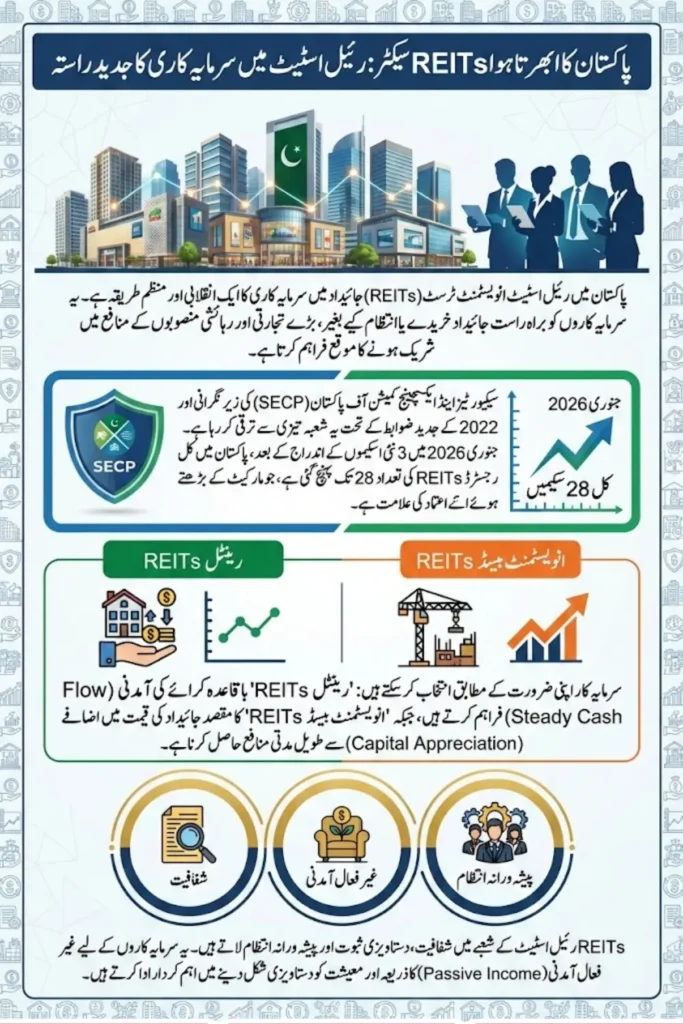

January 2026 – A Milestone for Pakistan’s REIT Industry

January 2026 marked another positive step for Pakistan’s REIT market as SECP registered three new REIT schemes.

This development signals strong momentum in the sector.

Three Newly Registered REIT Schemes

The newly registered schemes include:

- Two Rental REIT schemes

- One Investment-Based REIT scheme

All are approved under the updated 2022 regulations.

Total Registered REIT Schemes Reach 28

With these additions:

- Total REIT schemes = 28

- Market depth continues to improve

- More choices become available for investors

Understanding Rental REIT Schemes

Rental REITs focus on properties that generate regular rental income.

These schemes are designed for investors seeking steady cash flow rather than speculative gains.

How Rental REITs Work

Rental REITs:

- Acquire completed properties

- Lease them to tenants

- Collect rental income

- Distribute profits to investors

Income Generation Model

Income usually comes from:

- Monthly rents

- Long-term lease contracts

- Periodic rent escalations

This creates predictable income streams.

Understanding Investment-Based REIT Schemes

Investment-Based REITs primarily aim for capital appreciation rather than regular rental income.

These schemes may invest in:

- Development projects

- Under-construction properties

- Strategic land acquisitions

Capital Appreciation Explained

Profits are earned when property values increase and assets are sold at higher prices.

Long-Term Wealth Creation

These REITs suit investors who:

- Have long-term horizons

- Can tolerate volatility

- Seek higher growth potential

You can also read: CM Punjab Laptop Program Portal Live Good News

Key Differences Between Rental and Investment-Based REITs

| Feature | Rental REIT | Investment-Based REIT |

|---|---|---|

| Main Objective | Regular income | Capital growth |

| Risk Level | Lower | Higher |

| Income Type | Rental yield | Price appreciation |

| Investor Profile | Conservative | Growth-oriented |

Purpose

Rental REITs focus on stability, while Investment-Based REITs target expansion.

Risk and Return Profile

Higher risk generally comes with higher potential returns.

Who Can Invest in These REIT Schemes

Initially, these schemes can raise funds from accredited investors.

Accredited Investors

- Financial institutions

- Corporates

- Insurance companies

- High net-worth individuals

Why Accreditation Matters

Accredited investors:

- Understand financial risks

- Have sufficient capital

- Can absorb potential losses

Mandatory Listing Requirement Explained

Both rental and investment-based REIT schemes must be listed within one year of property transfer.

One-Year Listing Rule

This ensures:

- Faster market access

- Greater transparency

- Price discovery

Benefits of Early Listing

- Liquidity for investors

- Public visibility

- Better governance

How REIT Schemes Raise Funds

REITs raise funds by offering units to investors.

Fundraising Mechanism

- Private placement

- Public offering after listing

- Institutional subscriptions

Investor Participation

Investors purchase units and become beneficiaries of income and gains.

Growth of Pakistan’s REIT Sector

The REIT sector has shown steady expansion over recent years.

Recent Trends

- Rising registrations

- Growing institutional interest

- Increased awareness

Market Confidence

More developers and investors are trusting REIT structures.

Structural Reforms Through REITs

REITs introduce discipline into real estate markets.

Documentation

- Legal titles

- Verified ownership

- Proper contracts

Transparency

- Audited financials

- Public disclosures

- Regulatory reporting

Governance and Investor Protection

Strong governance is a cornerstone of REIT regulations.

Regulatory Oversight

SECP monitors:

- Compliance

- Reporting

- Operations

Risk Management

- Independent trustees

- Professional managers

- Asset valuation checks

Benefits of REITs for Investors

REITs offer multiple advantages.

- Passive income

- Lower entry barrier

- Diversification

- Professional management

Passive Income

Investors earn without managing properties.

Portfolio Diversification

Real estate exposure balances stock and bond investments.

Benefits of REITs for Real Estate Industry

REITs modernize the sector.

- Formalization

- Institutional funding

- Project quality improvement

Formalization

Informal practices gradually reduce.

Professional Management

Projects are run by experts.

Challenges Facing REITs in Pakistan

Despite progress, challenges remain.

Awareness Issues

Many investors still lack understanding.

Market Volatility

Economic fluctuations affect property values.

Future Outlook of REIT Market in Pakistan

The future looks promising.

Expansion Opportunities

- More sector-specific REITs

- Infrastructure-focused REITs

- Residential REITs

Long-Term Vision

REITs may become mainstream investment tools.

Step-by-Step Guide to Investing in REITs

- Learn about REIT types

- Review financial reports

- Compare returns

- Choose suitable scheme

- Invest through authorized channels

Research

Study performance and management quality.

Selection

Match REIT with goals.

Investment

Allocate funds wisely.

You can also read: Hunarmand Naujawan Parwaaz

Important Considerations Before Investing

- Risk tolerance

- Investment horizon

- Income vs growth preference

Risk Assessment

Understand potential losses.

Investment Goals

Define objectives clearly.

Conclusion

The registration of three new REIT schemes in January 2026 reflects the growing maturity of Pakistan’s REIT market. With strong regulatory backing, clearer rules, and increasing investor participation, REITs are shaping a more transparent and structured real estate sector. For investors, REITs provide an accessible gateway to property investment, offering both income and growth opportunities. As awareness increases and more schemes enter the market, REITs are set to become a cornerstone of Pakistan’s capital market ecosystem.

FAQs

1. What is the minimum investment in REITs?

It depends on the scheme and offering structure.

2. Are REITs safer than direct property investment?

They offer better transparency and regulation.

3. Can individuals invest in REITs?

Yes, once schemes are publicly listed.

4. Do REITs pay regular income?

Rental REITs typically distribute periodic income.

5. Are REIT returns guaranteed?

No, returns depend on market performance.