The Government of Pakistan has introduced the Prime Minister Youth Business & Agriculture Loan Scheme (PMYB&ALS) 2025, a major initiative aimed at empowering the youth through affordable financing. This scheme provides financial support to young entrepreneurs, skilled workers, small business owners, and farmers to either start or expand their ventures.

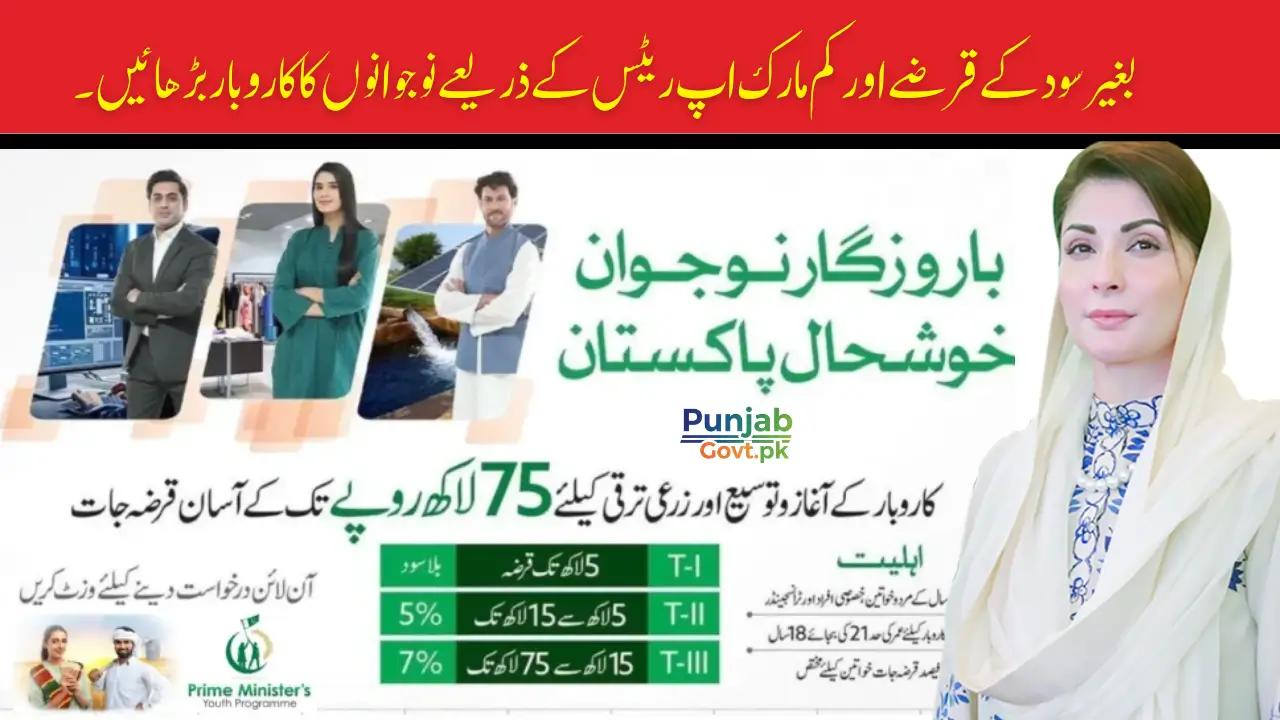

The loan scheme is structured across three tiers, offering up to Rs. 7.5 million with interest rates as low as 0% in Tier-1. It is open to a wide segment of the population, with a simplified digital application process, minimal documentation, and participation from both Islamic and conventional banks across the country.

Why the PM Youth Loan Scheme 2025 Matters

In today’s challenging economic climate, many young people struggle to access funding for their business ideas. The PMYB&ALS addresses this issue by removing the traditional barriers to finance such as high interest rates, complicated paperwork, and strict collateral requirements.

By offering interest-free loans and low markup options, this scheme:

- Encourages entrepreneurship among youth

- Helps small businesses access working capital

- Supports modern agricultural ventures and rural development

- Promotes self-employment and innovation

Whether you’re running a small home business or planning a medium-scale enterprise, this program provides a tailored financial solution to your needs.

You can also read: CM Punjab Khidmat Card Program 2025 Registration

Loan Categories, Amounts, and Markup Rates

The scheme is divided into three tiers based on the loan amount and the borrower’s financial needs. Each tier has its own markup rate, maximum loan tenure, and security requirements.

Here’s a quick overview:

| Tier | Loan Amount (PKR) | Markup Rate | Tenure (Max) | Collateral |

|---|---|---|---|---|

| Tier-1 (T1) | Up to 500,000 | 0% (Interest-Free) | Up to 3 years | No collateral (personal guarantee) |

| Tier-2 (T2) | 500,001 – 1,500,000 | 5% | Up to 8 years | May require security (as per bank) |

| Tier-3 (T3) | 1,500,001 – 7,500,000 | 7% | Up to 8 years | Security required (e.g., vehicle or asset) |

These loans are suitable for different stages of business from micro setups to more established medium-sized enterprises.

Key Features of the Scheme

The PM Youth Loan Scheme 2025 stands out due to its youth-focused design and ease of access. Some of the key features include:

- Interest-free loans up to Rs. 500,000

- Low markup rates of 5% and 7% for higher tiers

- No collateral required for Tier-1 loans

- Loan tenures of up to 8 years, depending on the tier

- Accessible to all sectors, including agriculture, services, IT, and manufacturing

- Both Islamic and conventional banks involved in processing applications

This structure helps accommodate a wide range of applicants, from small vendors to mid-level industrial ventures.

Eligibility Criteria

To ensure broad access while maintaining transparency, the government has set clear eligibility criteria. Applicants must meet the following conditions:

- Pakistani nationality with a valid CNIC

- Age between 21 and 45 years

- Minimum age is 18 for IT or e-commerce applicants

- Education not mandatory, except for IT/e-commerce where matriculation is required

- Business can be new or existing

- Firms, partnerships, individuals, and companies can all apply (age applies to at least one principal)

This inclusivity ensures that young people from all walks of life can benefit from the scheme.

You can also read: Ehsaas Program 25000 CNIC Check 2025

How to Apply Online for PMYB&ALS 2025

The application process has been made simple and fully digital, making it easier for applicants even in remote areas to apply without visiting bank branches unnecessarily.

Follow these steps:

- Visit the official PM Youth Programme portal

- Click on “Apply Now”

- Enter your CNIC number and issue date

- Select the loan tier (T1, T2, or T3)

- Choose a participating bank (Islamic or conventional)

- Fill in your personal, business, and financial details

- Upload the required documents

- Submit the form and receive your tracking number via SMS

Required Documents

To apply, applicants need to upload clear digital copies of the following:

- CNIC (front and back)

- Passport-size photograph

- Education certificate (only for IT/e-commerce)

- Business plan (basic for T1; detailed for T2/T3)

- Bank account details

- Utility bill (for existing business premises)

Make sure your documents are readable and uploaded in the correct format to avoid delays in processing.

Who Should Apply?

This scheme is ideal for:

- Fresh graduates with a viable business idea

- Skilled individuals starting a small venture

- Farmers needing agri-equipment or working capital

- Existing businesses planning to expand

- IT or e-commerce entrepreneurs with online setups

You can also read: CM Punjab Laptop Scheme Phase 5 Check Complete Details

Suggested Business Ideas for Each Tier

Each loan tier supports different business types. Here are some examples:

Tier-1 (Up to Rs. 500,000):

- Home bakery or kitchen

- Tailoring or embroidery setup

- Mobile repair or electronics kiosk

- Mini dairy or poultry business

- Drip irrigation systems for small farms

Tier-2 (Rs. 500,001 – 1.5 million):

- Retail shop or salon setup

- Tunnel farming or dairy equipment

- Small delivery vehicle for online store

- Livestock expansion

Tier-3 (Rs. 1.5 – 7.5 million):

- Light manufacturing unit

- Commercial farming (greenhouse, cold storage)

- Medium-scale IT or software company

- Agri-machinery and farm logistics services

These examples help you choose the right tier based on your business needs and growth plans.

Banks Participating in PM Youth Loan 2025

The scheme is being processed by a network of public and private banks. These include:

- Habib Bank Limited (HBL)

- Bank of Punjab (BOP)

- Al Baraka Islamic Bank

- Sindh Bank

- Askari Bank

- Others as designated by the State Bank of Pakistan

Make sure to choose a bank that actively processes PMYB&ALS applications in your area for smoother handling.

Tracking Your Loan Application

After submission, you can track your loan status using the “Track Application” option on the official portal. You’ll need to enter:

- CNIC Number

- Issue date

- Registered mobile number

- Date of birth

This helps keep you updated on your application status without visiting the bank.

You can also read: 8171 Tracking Portal Restoration and Check Payment

Final Thoughts

The PM Youth Loan Scheme 2025 is a timely and practical initiative by the Government of Pakistan to tackle youth unemployment and promote economic self-reliance. With interest-free microfinance and low-markup larger loans, it offers a powerful opportunity for youth to turn their skills, ideas, and efforts into sustainable businesses.

Whether you’re a small-town entrepreneur, a recent graduate, or a farmer with a plan, this scheme provides the tools and support you need to move forward.