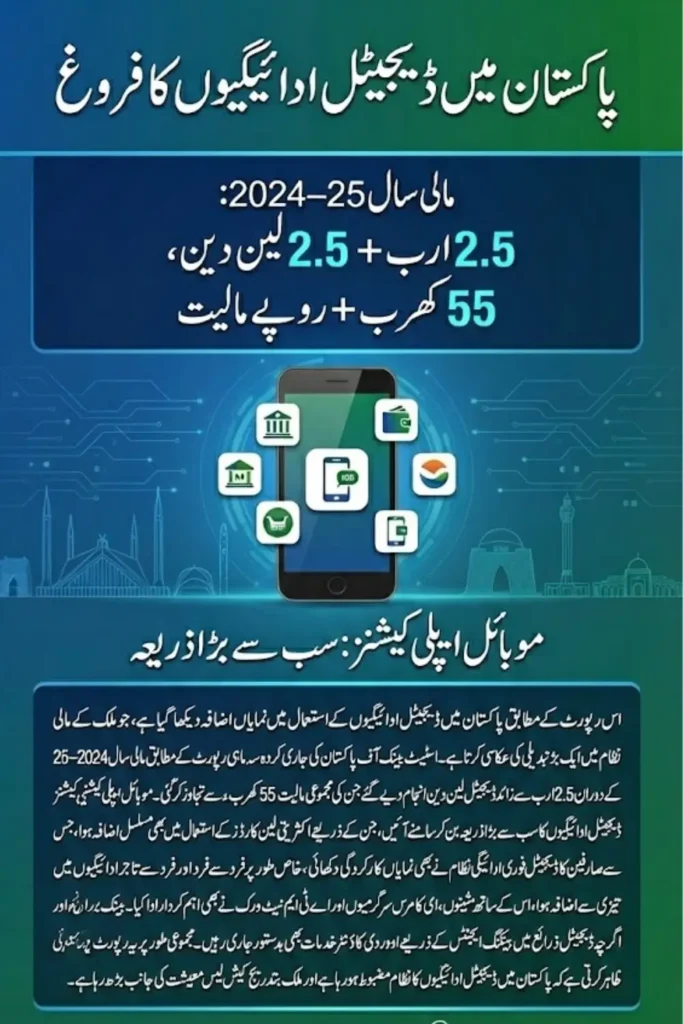

Digital payments in Pakistan have experienced remarkable growth, reflecting a strong shift toward technology-driven financial services. During the financial year 2024–25, the public increasingly relied on digital payment channels for everyday transactions, signaling a major transformation in consumer behavior.

According to the State Bank of Pakistan (SBP), more than 2.5 billion digital transactions were processed during the year, with the total value exceeding Rs. 55 trillion. This growth highlights the expanding trust in digital platforms and the success of financial inclusion initiatives across the country.

SBP Quarterly Payment Systems Report Overview

The State Bank of Pakistan released its Quarterly Report on Payment Systems for the first quarter of fiscal year 2025–26. The report provides a detailed review of Pakistan’s payment ecosystem, emerging trends, and progress made in strengthening digital financial infrastructure.

You can also read: XPENG X9 and G6 Official Prices

The analysis covers a wide range of payment channels, including mobile apps, internet banking, digital wallets, cards, ATMs (excluding cash withdrawals), Raast, and over-the-counter services. Together, these channels demonstrate how digital and physical systems are evolving side by side.

Strong Growth in Digital Payment Transactions

Digital payment channels recorded significant growth both in volume and value during FY 2024–25. These channels played a key role in enabling faster, safer, and more convenient transactions for individuals and businesses.

Digital payment channels covered in the report include:

- Mobile banking applications

- Internet banking platforms

- Digital wallets

- Payment cards

- ATMs (non-cash transactions)

- Raast Instant Payment System

The combined performance of these channels reflects Pakistan’s rapid movement toward a cash-lite economy.

Mobile App-Based Payments Lead the Market

Mobile applications emerged as the most widely used digital payment channel in Pakistan. Banks, branchless banking providers, and electronic money institutions (EMIs) collectively processed 2.0 billion transactions through mobile apps alone.

These transactions accounted for 81 percent of all digital payments and reached a total value of Rs. 33.7 trillion. The popularity of mobile payments is driven by ease of use, quick processing, and widespread smartphone adoption.

Common uses of mobile app payments include:

- Person-to-person transfers

- Utility and bill payments

- Online shopping payments

- In-store merchant payments through wallets

Expansion of Internet Banking and Payment Cards

Internet banking continued to grow steadily as more users adopted digital channels for routine financial activities. This expansion reflects improved digital literacy and enhanced banking platforms offered by financial institutions.

At the same time, the number of payment cards in circulation rose to 61.3 million. Debit cards dominated the market, representing 90 percent of total cards, while credit cards accounted for 4 percent, indicating cautious but stable credit usage.

Raast Instant Payment System Performance

The Raast Instant Payment System maintained strong momentum during the quarter. Person-to-person (P2P) transactions reached 535 million, showing a 31 percent increase, with a total value of Rs. 11.3 trillion.

You can also read: 8123 Ration Card 2026 Application Process

Raast person-to-merchant (P2M) payments also showed impressive growth. Transactions doubled to 4.3 million, amounting to Rs. 17.0 billion, highlighting rising merchant acceptance.

Raast overall performance:

- Total transactions: 544 million

- Total value: Rs. 12.8 trillion

POS, E-Commerce, and ATM Network Growth

Card-based retail and e-commerce activity continued to expand across Pakistan. On average, 1.5 million card transactions were processed daily at point-of-sale (POS) terminals and online platforms.

The ATM network also remained a critical component of the payment ecosystem. A total of 20,527 ATMs handled 267 million transactions worth Rs. 4.5 trillion nationwide.

ATM Network Snapshot

| ATM Performance Indicator | Details |

|---|---|

| Total ATMs | 20,527 |

| Total Transactions | 267 million |

| Transaction Value | Rs. 4.5 trillion |

| Average Daily Transactions per ATM | 142 |

| Average Transaction Size | Rs. 16,800 |

Role of Physical Banking and Branchless Banking

Despite the rapid rise of digital payments, physical banking channels continued to support retail transactions. Across the country, 19,852 bank branches and 756,480 branchless banking agents provided over-the-counter services.

Bank branches processed 137 million transactions worth Rs. 110 trillion, while branchless banking agents facilitated 129 million transactions amounting to Rs. 0.9 trillion, ensuring access for users who still prefer assisted services.

Conclusion

The State Bank of Pakistan’s latest report clearly shows that digital payments are becoming the backbone of Pakistan’s financial system. Strong growth across mobile apps, Raast, cards, and internet banking reflects rising confidence in digital solutions.

With continued investment in infrastructure and financial inclusion, Pakistan’s payment ecosystem is well-positioned for sustained growth, offering faster, safer, and more accessible financial services to the public.

News Via: https://propakistani.pk/2025/12/30/81-of-all-digital-transactions-in-pakistan-are-done-using-mobiles/